About Us

Arrowhead Industry Capital (AIC) is an independent private equity firm focused on growth-oriented investments across the energy and infrastructure sectors

Based in New York, we partner closely with leading management teams to create value through the acquisition, development, and scaling of businesses and assets

Through AIC and prior roles, the team has invested more than $1.7 billion of equity in transactions representing valued at over $10 billion

Our value creation approach emphasizes operational improvement, strategic growth initiatives, and thoughtful capital structuring, with a focus on downside protection through conservative leverage and rigorous underwriting

Investment Criteria

Capital & Structure

Target equity investments of $10 - $50 million across preferred and common equity

Ability to take majority and minority positions. As a result, total enterprise value may be substantially larger than invested capital

Structured with a focus on downside protection, flexibility, and resilience across economic and commodity cycles

Geographic focus on North America

Investment Themes & Asset Types

We invest in opportunities that enable:

Organic growth initiatives

Greenfield development

Brownfield asset repositioning and re-deployment

Platform acquisitions and build-and-scale strategies

Sector Focus:

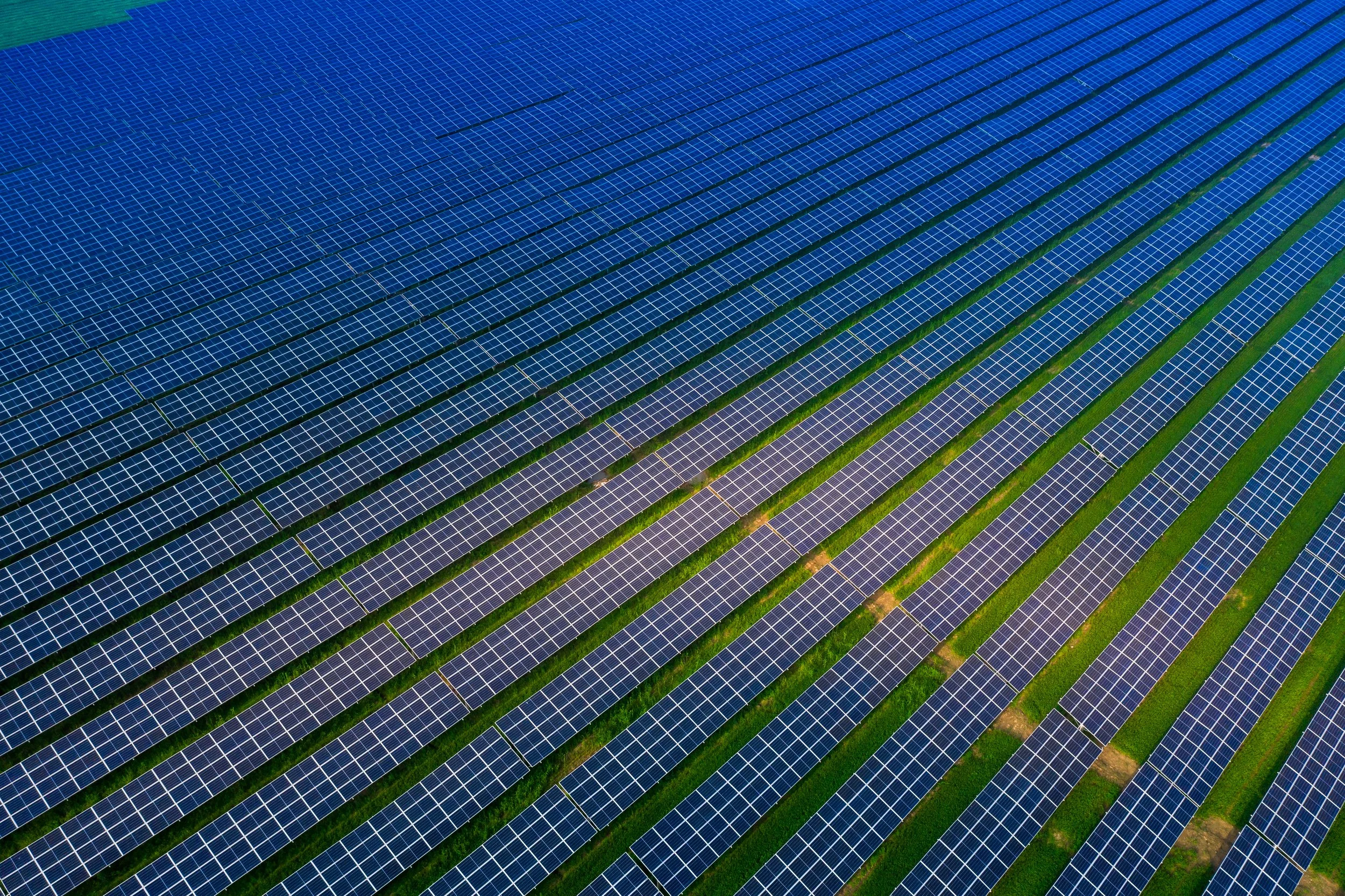

AIC targets sectors benefiting from durable, positive secular trends, including:

Power assets and development

Digital, data center, and AI-enabling infrastructure

Midstream energy infrastructure, including oil, natural gas, LPG, and water

Select equipment & service opportunities supporting these sectors

Principles

Enduring value requires rigor and time

Value creation in infrastructure is earned through disciplined execution. We believe exceptional management teams, grounded in sound principles, structured processes, and rigorous analysis with continuous feedback, are best positioned to solve complex problems, drive positive change, and compound durable value.

Partnership with clarity

AIC works as a true partner to management teams to amplify their time and effort. We prioritize transparency, clear objectives, and direct communication so issues surface early and decisions get made.

Measured impact

We believe attractive returns and positive outcomes for communities and the environment can coexist. Where relevant, we integrate climate and sustainability considerations into underwriting and track what we can measure over time.